No.72

No.72

地方税の研究

Research on Local Taxes

税制の故きをたずね、新しきを検証

税務のプロに役立つ情報も

Evaluate New Tax Systems through Reviewing Old Ones

Also provides information helpful to tax professionals

商学部

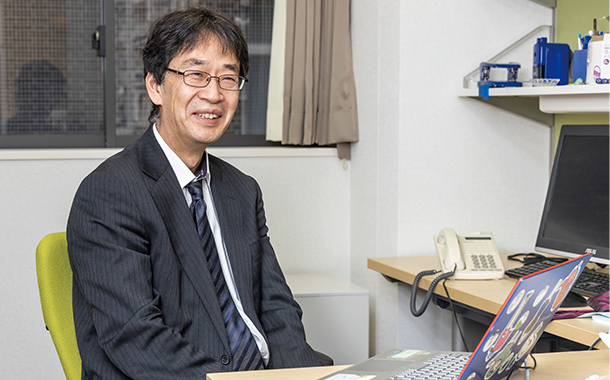

石田 和之 教授

Faculty of Business and Commerce

Professor Kazuyuki Ishida

石田教授の著書・共著

Books authored by Professor Ishida

住民税、固定資産税などの地方税は都道府県、市町村が課税し、住民が直接納める税金。その地域の教育や福祉などの公共サービスに使われる大切な財源だ。地方税を専門とする商学部の石田和之教授は、社会・経済の変化に伴い変わり続ける税制について、実証的な分析研究に取り組む一方、その改正の歴史的背景や経緯を分かりやすく解説する。また、税制の検討会などにも出席し、公平・中立・簡素な税制に資するべく取り組んでいる。

Local taxes, such as resident tax and fixed asset tax, are imposed by municipalities and paid by residents directly to their municipalities. These local taxes are important financial resources that are spent on education, welfare, and other public services in local areas. Professor Kazuyuki Ishida of the Faculty of Business and Commerce specializes in local taxes. While working on demonstrative, analytical research on tax systems that are ever-changing with changes in society and the economy, Prof. Ishida provides easy-to-understand explanations about the historical background and circumstances of revisions to these tax systems. Prof. Ishida also attends committee meetings on tax systems, where he works to make tax systems fairer, simpler, and more neutral.

個人住民税は現年課税化すべきか

専門の研究分野を教えてください。

財政学、租税制度を専門に、その中でも特に日本の地方税を対象にしています。

地方税について、最近はどんな議論があるのでしょうか。

最近の話題ですと、例えば「個人住民税の現年課税化」があります。今の個人住民税は前年の所得に課されており、それを前年課税といいます。給与所得者ですと、通常、所得税などが毎月の給料から差し引かれて、12月に年末調整をします。さらに必要があれば、最終的には確定申告することになります。住民税はその確定した前年所得の金額に基づいて決定します。

このように、現在の住民税は前年課税となっているわけですが、所得に対する税金はその年に課した方がよい、つまり現年課税にすべきいう議論があります。この議論は以前からあって、総務省の検討会でも、10年ほど前からずっと議論されてきました。

さかのぼると、現在の住民税の制度が始まったのが1950年。当時から、現年課税の方がよいという意見がなかったわけではありませんが、諸般の事情があって前年課税を長らく続けてきました。しかし、世の中も変わり、不都合な部分が指摘されるようになってきた。そろそろ現年課税に切り替えるべきだという風潮があります。

どのような不都合が生じるのでしょうか。

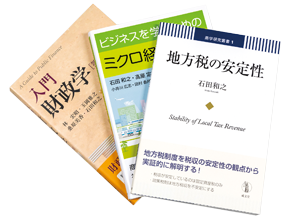

ずっと日本に住み、そのまま定年退職を迎えるのであれば、大して変わりません。単に1年遅れでの課税が、その年の所得に応じた課税になるだけです。しかし、最近、問題になっているのが、日本で働く外国人、海外で働く日本人が増えたことです。そうすると、翌年税金を徴収しようにも、既に海外に出国している場合、納税されるかどうかが分かりません。一応、出国する際は税金を一括で納めるというルールがありますが、そんなルールも知らずに、悪気なく出国してしまうケースもあります。徴収する側も、この人は旅行のために出国するのか、それとも本国に帰るのか、出国時点では分かりません。近年このような例が増えてきましたが、こういった移動は今後もっと増え、不都合もさらに大きくなるでしょう。

例えば国内でも、別の市町村に引っ越した人に、「昨年住んでいた時の住民税を納めてください」と言われても、もう今は違うところに住んでいるし、という気持ちになりますよね。やはり所得と課税の年を合わせられるなら、現年の方がメリットがあるのではという話になってくる。しかし事務的な面でのデメリットがあり、なかなか先に進まないという状況があります。

Should personal resident tax be imposed on the current year's income?

What are your research specialties?

My specialties include finance and tax systems, particularly Japanese local taxes.

What are some of the recent topics on local taxes?

Recent topics include, for example, whether personal resident tax should be imposed on the current year's income. Currently, personal resident tax is imposed on the previous year's income, thereby adopting the previous-year-based tax system. If you are a salary earner, usually your income tax and other taxes are deducted from your monthly salary and are adjusted in December. If further action is necessary, you will eventually file a final return. Your resident tax is determined based on the finalized amount of your previous year's income.

Thus, current resident tax is imposed on the previous year's income. Then there is the argument that it's better to impose any income-based tax in the current year or, in other words, on the current year's income. This argument is long-standing, and has been discussed for about 10 years at the committee of the Ministry of Internal Affairs and Communications ("MIC"), among other forums.

Looking back, the current resident tax system started in 1950. It is not that no one said back then that a current-year based tax system was better, but for various reasons we have continued to use the previous-year-based tax system for a long time. However, the world has changed and some people have started to point out the downside of the previous-year-based tax system. There is a trend where we should switch to a current-year-based tax system before too long.

What downside will the previous-year-based tax system have?

If you live in Japan all your life until you retire, there won't be much change. It's simply that you'll be taxed on your current year's income instead of being taxed one year later on that income. However, one recent issue is the increase in the number of foreign people working in Japan and Japanese people working overseas. In these cases, if these people have already left Japan when the authorities try to collect tax from them the following year, the authorities will never know if these people will pay tax. There is actually a rule that requires a taxable person to pay tax in a lump sum when leaving Japan, but there are cases where the taxable person innocently leaves Japan without knowing of that rule. When the taxable person is leaving Japan, the tax collector has no knowing whether this person is leaving for travel or returning to his home country. Recent years have seen an increasing number of these cases. These moves of people will increase further in the future, with the downside growing.

For example, even in Japan, if a person moves to another municipality and is asked by the previous municipality to pay resident tax for the previous year because he lived there then, the person would feel reluctant to pay because he no longer lives there, wouldn't he? These things support the argument that a current-year-based tax system is eventually more advantageous, if they can impose tax on the current year's income. However, a current-year-based tax system has some administrative disadvantages, and this prevents things moving forward.

在留外国人数の推移と我が国の総人口に占める割合の推移

Changes in the Number of Foreign Residents and Their Percentage of Japan's Total Population

出所:出入国在留管理庁「2022年版出入国在留管理」 Source : Immigration Services Agency of Japan

忖度なしに、地道に、税制の在り方を問う

最新の税制改正の動向にも取り組まれているのですね。

はい、継続して調査をしています。その他にも、総務省の個人住民税の検討会に出席して、研究成果を踏まえ、過去の経緯の話もしながら、議論に参加する機会もあります。

研究活動は文献を収集し、データを分析することだけではなく、日ごろの研究が社会と密接に関わっているのですね。

研究者の仕事の仕方にもいろいろあると思いますが、世の中とどうつながるかは大切だと思います。私であれば、財政学の中で税制を専門にしていますので、税のプロフェッショナル、例えばお役所で税制改正の実務に携わる人、税の賦課徴収を担当する税務課職員などとのかかわりは意識します。

研究者として心掛けていることを教えてください。

忖度をしないことです。お役所の事業に対して批判的なことをいう時など、その事業を担当している人の顔や名前が思い浮かぶこともあります。こんなことを書くと誰かに何か言われるかもしれない、あの人はどんな風に思うだろうか、など思わず、自分の考えを率直に述べることを心掛けています。

現在の税制で改正した方が良いと感じていることはどのようなことですか?

個人的には、課税単位は個人か世帯かという問題に注目しています。日本の場合、税金は個人単位です。一方、社会保障や福祉は、世帯単位です。両者で経済力のとらえ方が異なり、片方は個人単位、片方は世帯単位になっているわけです。

所得基準はさまざまな場面で使われます。例えば2021年度に、コロナ禍での経済対策として18歳以下の子どもへの10万円相当の給付がありました。この支援には所得制限があり、世帯主だけの所得を基準に、給付の可否が決められました。世帯主に960万円以上の収入がある世帯は給付を受けられませんが、共働きで例えば800万円ずつ収入がある場合、世帯収入が合計1600万円ですが給付の対象になるといったことが起こっていました。こうした不都合は以前からあって、その度に議論されていました。最近まではその議論さえも下火でしたが、先日、自民党幹事長が世帯単位を支持する発言をしたことで、今、世間の関心が急激に高まっています。

Consistently asking how tax systems should be, without thinking of the feelings of others

You are also working on the recent trends of revisions to tax systems, aren't you?

Yes, that's one of the things I study. Other than that, I also have opportunities to attend meetings of the MIC's committee on personal resident tax, where I participate in discussions based on my research results and mentioning the history of the system.

Your research activities include not only collecting literature and analyzing data but also constant research that is closely linked to society.

I think there are various ways for researchers to do their work, but I think how they should be connected to the world is important. In my case, because I specialize in tax systems in the field of finance, I'm conscious of my relationship with tax professionals, such as, for example, persons who actually work on revisions to tax systems at government offices, and tax department employees who are in charge of imposing and collecting taxes.

What things do you keep in mind as a researcher?

Not to conjecture about the feelings of others. Sometimes, when I do things like saying something critical of government programs, the faces and names of people responsible for these programs come to my mind. I make a point of candidly stating my opinion without thinking things like, "If I write such a thing, someone may criticize me," or "What will he think of this?"

What are things about the current tax system that you think would be better to revise?

Personally, I'm looking at the issue of whether tax should be imposed on a personal or household basis. In Japan, tax is imposed on a personal basis. On the other hand, social security and welfare benefits are paid on a household basis. Because the two systems regard economic resources differently, one is on a personal basis and the other on a household basis.

Income criteria are used in various settings. For instance, in fiscal 2021, a 100,000 yen benefit was paid to each child at or under the age of 18 as an economic measure against the COVID-19 pandemic. This support was income tested, and whether or not a child was eligible for the benefit was determined based solely on the income of the head of the household. A household wasn't eligible if its head had an income of 9.6 million yen or more. However, if both parents worked and each had an income of 8 million yen, the household was eligible for the benefit even though the total household income was 16 million yen. These kinds of problems have existed for a long time and have been discussed each time as they arose. Until recently, even these discussions were not active, but the other day the secretary general of the Liberal Democratic Party made statements supporting the household-based system, and this has caused a surge in public interest.

(写真・左)租税資料館賞 (写真・右)日本地方自治研究学会賞

税務のプロをアシストする発信を10年以上

地方税の実務研究誌『月刊 税』(ぎょうせい)で、長く連載記事を担当されているそうですね。

税制改正は毎年行われていますが、なぜそのような変更を行うことになったのかが、結構忘れられがちです。税制はその時の社会の価値観や財政を反映するもので、改正された理由が必ずあります。時代が変わり、不都合な部分が出てきたので見直そうという時に、制度ができた理由や経緯をしっかり理解した上で、制度改正した方がよいと思います。こうした考えで『地方税制温故知新』という連載記事を担当しています。毎月掲載で計137回(2023年3月現在)、10年を超えました。

研究者としての仕事は、やはり論文を書くことがメインだと思います。論文はその都度、テーマを選び、実証データを分析してまとめます。これまでに、『資産保有課税における課税標準の選択:固定資産税(日本)とレイト(香港)の比較分析の視点』で租税資料館賞、『地方税の安定性』で日本地方自治研究学会賞を受賞することもできましたが、論文を書くことだけではなく、いろんな媒体を通して、研究成果を社会に還元することもまた私の仕事かなと思っています。

『月刊 税』の主な読者は、都道府県や市町村の税務課で働いている方々で、例えば全国の窓口で、住民から「住民税はなぜこう変わるんですか」といった質問があった時に、背景なども含めて「なぜ?」に答える説明をしてほしいと思っています。実務上、誰かの何かに少しでも役に立てればという思いでこれからも続けていきたいですね。

10-year publication of articles that assist tax professionals

I hear you have long published a regular article in "Gekkan Zei," a practical research magazine on local tax (published by Gyosei Corporation).

While the tax system is revised every year, people often forget why these revisions were made. The tax system reflects values in society and financial circumstances of the time, and there are always reasons why the revisions were made. I think that when revisions are being considered due to changing times and resulting problems, it would be better to revise the system after firmly understanding the reasons for and background to the creation of the system. This is why I write a regular article titled "Chiho zei sei onko chishin" (Local tax system: Discover new things by learning from the past). It's a monthly article. I have written a total of 136 of them (as of February 2023) over more than 10 years.

I think the main part of my job as a researcher is eventually writing papers. For each paper, I select a topic and analyze verified data before putting the paper together. So far, I have been able to receive the Institute of Tax Research and Literature Award for a paper titled "Selection of Tax Bases in Asset Taxation: A perspective in comparative analysis of fixed asset tax (Japan) and general rates (Hong Kong)," and the Nippon Urban Management and Local Government Research Association (NUMLGRA) Award for another paper titled "Stability of Local Tax." However, I think writing papers is not what my job is all about -- I think it is also my job to share my research results with society through various media.

The main readers of the Gekkan Zei magazine are people working at prefectural or municipal tax departments. I'm hoping that when, over their counters located nationwide, they are asked by residents why resident tax is changing like that, they will provide explanations that answer the "why" question, including the background, etc. I hope to continue writing articles in the future with the intention of being of some small help to someone for something in a practical setting.